How to Claim your Tax Credit for Home Charging Services

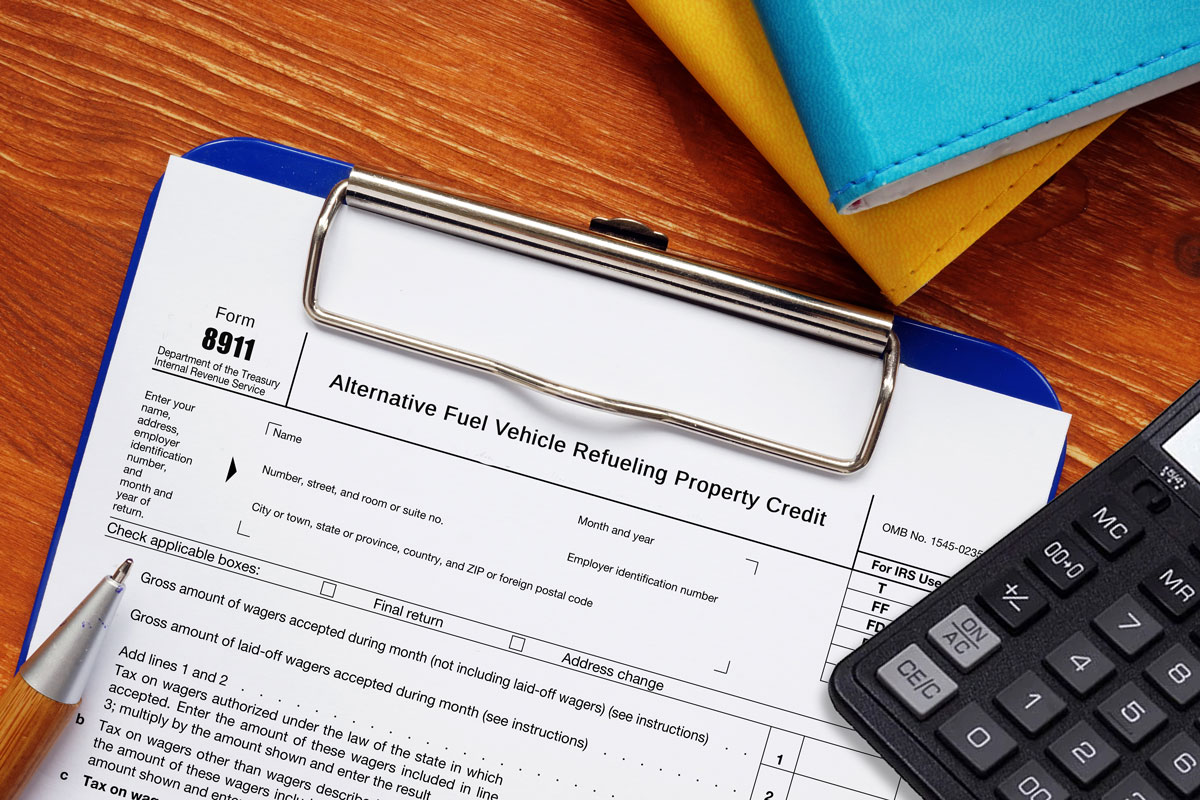

Federal tax credits for EV charging stations may be available. With our services you may qualify for 30% off the cost of your home charger and installation, up to $1,000. *Update: Since 2022 there are new eligibility requirements* Please check IRS.gov Form 8911 to see if you qualify.

Maximize savings by claiming your tax credit!

Complete Your Installation With Us

Complete our easy online form to get started a quote and get your install scheduled.

Save your Invoice

Keep the Invoice for Installation services. You will need this to calculate a figure to input in your taxes. We will send you a PDF receipt once installation is complete. Save this file.

Save your Reciepts

Save all your receipts including your paid invoice for the installation.

Fill out Tax Form 8911

*Complete your full tax return and fill in form 8911. You'll need to know your tax liability to calculate the credit. Talk with your tax professional to learn more! *Update: Since 2022 there are new eligibility requirements* Please check IRS.gov to see if you qualify.

Submit your tax forms

Submit your tax forms along with documentation of what you spent on your charger and installation. Your tax liability will be lowered by the credit you qualify for.

Free money for Going Electric!